Fulton County, Indiana

Fulton County is focused on creating a prosperous future while preserving our history.

Accident ReportsAgricultural Land RatesAlcohol PermitsAppealsBenefitsCounty ParksCourt Appointed Special Advocate (CASA)Demand Notices – Personal Property and Mobile HomesEstate ClaimsDeductionsFilling Wills with the Circuit Court Clerk - Chapter 10Firearm PermitGIS Data/Property Record CardsGroundwater ProtectionInmate CommissaryInmate Mail ServiceInnkeepers TaxOnline Records SearchLand OrderLEPCMarriage InformationMediation Program for Dissolution Cases & Paternity CasesVisitationMobile Home CommunitiesMobile Home Information

The agricultural land base rates for tax year 2023 payable in 2024 have been set by the Department of Local Government Finance at $1,900 per acre.

Prior year agricultural rates are as follows:

2022 pay 2023 $1,500

2021 pay 2022 $1,290

2020 pay 2021 $1,280

2019 pay 2020 $1,560

Alcohol and Beverage Permits are available once taxes are paid for the business and property they are operating at. Forms should be filled out and presented for clearance to the Fulton County Treasurer’s Office at 125 East 9th Street, Rochester, IN 46975.

Appeals Process

Note also that three things may happen on appeal

- the assessed value may increase;

- it may decrease;

- it may remain the same

Should a property owner disagree with their assessment, they are entitled to an appeal. All appeals should begin with the Fulton County Assessor. A review of the property record card is important to ensure that all of the features of the property have been reported correctly. These include square footage, number of plumbing fixtures, finished or unfinished attics and basements, etc. Any discrepancy of these objective portions of the assessment may be handled at that time. Form 130

A summary of the various levels of appeal are as follows

An appeal of the current year's assessment may have two different filing deadlines which are based on when the Form 11 notice of assessment is mailed. if the Form 11 is mailed before May 1 of the assessment year, the filing deadline is June 15 of that year. If the Form 11 is mailed after April 30 of the assessment year, the filing deadline is June 15 in the year that the tax statements are mailed (IC 6-1.1-15-1.1). Taxpayers will need to complete Section I and II of the Form 11 for that type of appeal.

An appeal can also be filed to correct certain types of specific errors covered in IC 6-1.1-15-1.1 (a) and (b). This type or limited appeal must be filed not later than three years after the taxes were first due. Taxpayers should complete Section I & III of the Form 11 (formerly Form 133) for this type of appeal. More information on the appeals procedure is available on page 3 of the Form 11.

Petition to the Property Tax Assessment Board of Appeals (PTABOA)

The assessing official must hold the preliminary informal meeting with the taxpayer to resolve as many issues as possible. If no agreement is reached or the petition is not resolved at the informal level within 180 days of filing the appeal a hearing must be held. Property Tax Assessment Board of Appeals (PTABOA) must give the taxpayer and official at least thirty days notice of the hearing date. If the taxpayer cannot attend the hearing they must request a continuance at least ten days before the hearing. A taxpayer may request action without his presence or withdraw a petition at least 10 days before the hearing.

Petition to the IBTR (Indiana Board of Tax Review)

Taxpayer may appeal PTABOA's action to the IBTR. The taxpayer must file a Form 131 with the IBT within forty-five days of when the PTABOA's order is given to parties and must mail a copy of the petition to the other part, i.e. the assessing official.

*COMPENSATION

A monthly benefit depending upon rating percentage, with additional amounts for dependents of veterans with a 30 percent rating and above. This benefit is available for those veterans who have been able to establish a connection to a disability or illness etc., based upon military service.

*PENSION

A monthly benefit for a single veteran with wartime service and a suitable type of discharge. Additional amounts are available for those with dependents and those considered to be housebound or in need of aid and attendance. This benefit is determined by the veteran's income from all sources and the veteran's employability. Age is not a sole determining factor

*DEATH PENSION

A monthly benefit available to the surviving spouse of an eligible veteran. This benefit has a maximum dollar amount per month(contact this office for the current amount) for a surviving spouse with no dependents. Additional amounts are available for those with dependents or those who meet certain medical conditions. This benefit also is based upon the applicant's income from all sources.

*DEPENDENCY and INDEMNITY COMPENSATION [DIC]

Payments may be available for surviving spouses who have not remarried, unmarried children under 18, helpless children, those between 18 and 23 if attending a VA-approved school and low-income parents of deceased service members or veterans. To be eligible, the deceased must have died from a service-connected disease or injury, or died while on active duty. Willful misconduct of veteran will prevent award of DIC to surviving dependents.

*MEDICAL SERVICES

These benefits are established by the Veterans Health Administration and provided by the various medical centers and community-based outpatient centers (CBOCís). These benefits are for the veteran only and not the spouse or dependents except for those vets rated 100% for a service-connected disability. The veteran should contact the closest VAMC. In this area, it is the Marion Medical Center, 1700 E. 38th St., Marion or call: 1-800-498-8792. Veterans will need a copy of their DD FORM 214 or other proof of military service.

Anyone interested in these services should contact us to obtain more information and to determine eligibility.

*CLOTHING ALLOWANCE

Any veteran who is entitled to receive compensation for a service-connected disability for which he or she uses prosthetic or orthopedic appliances may receive an annual clothing allowance. The allowance also is available to any veteran with a service-connected skin condition that requires a prescribed medication that damages the veteran's outer garments.

*AID AND ATTENDANCE OR HOUSE-BOUND

A veteran who is a patient in a nursing home, who is otherwise determined by VA to be in need of the regular aid and attendance of another person or who is permanently house-bound, may be entitled to higher income limitations or additional benefits, depending on the type of pension received. This benefit is also for eligible widows who are entitled to benefits under the pension program and they also may be entitled to higher income limitations or additional benefits.

*EDUCATION AND TRAINING

POST 911 GI Bill

The Post - 9/11 GI Bill provides financial support for education and housing to individuals with at least 90 days of aggregate service on or after September 11, 2001, or individuals discharged with a service-connected disability after 30 days. You must have received an honorable discharge to be eligible for the Post -9/11 GI Bill..

The Post - 9/11 GI Bill will pay your tuition based upon the highest in-state tuition charged by a public educational institution in the state where the school is located. The amount of support that an individual may qualify for depends on where they live and what type of degree they are pursuing.

Tuition & fees directly to the school not to exceed the maximum in-state tuition & fees at a public Institution of Higher Learning. See chart listing maximum in-state tuition rates for more expensive tuition, a program exists which may help to reimburse the difference. This program is called the "Yellow Ribbon Program". A monthly housing allowance based on the Basic Allowance for Housing for an E-5 with dependents at the location of the school. For those attending foreign schools (schools without a main campus in the U.S.) the BAH rate is fixed at $1,347.00 for 2011 and $1,348.00 for 2010. An annual books & supplies stipend of $1,000 paid proportionately based on enrollment. A one-time rural benefit payment for eligible individuals. This benefit is payable only for training at an Institution of Higher Learning (IHL). If you are enrolled exclusively in online training you will not receive the housing allowance. If you are on active duty you will not receive the housing allowance or books & supplies stipend. This benefit provides up to 36 months of education benefits, generally benefits are payable for 15 years following your release from active duty. The Post-9/11 GI Bill also offers some service members the opportunity to transfer their GI Bill to dependents.

Montgomery GI Bill (Active Duty)

The Montgomery GI Bill (Active Duty) provides a program of education benefits to individuals who enter active duty for the first time after June 30, 1989, and receive an honorable discharge. Active duty includes full-time National Guard duty performed after Nov 29, 1989. Members of the Army and Air Force National Guard who enlisted between June 30, 1985 and Nov. 29, 1989, had to decide before July 9, 1997, to participate in the Montgomery GI Bill (Active Duty). To receive the maximum benefit, the participant must serve on active duty for three years. An individual also may qualify for the full benefit by initially service two continuous years on active duty, followed by four years of Selected Reserve service, beginning within one year of release from active duty.

To participate in the Montgomery GI Bill, service members have their military pay reduced by $100.00 a month for the first 12 months of active duty. This money is not refundable. The participant must have a high school diploma or an equivalency certificate before the first period of active duty ends. Credits granted by colleges for life experiences may be used to meet this requirement. Completing a minimum of 12 credit hours toward a college degree meets this requirement. Individuals who serve a continuous period of at least three years of active duty, even though they were initially obligated to serve less, will be paid the maximum benefit.

Benefits under this program generally end 10 years from the date of the veteran's last discharge or release from active duty, but some extenuating circumstances qualify for extensions. A veteran with a discharge upgraded by the military will have 10 years from the date of the upgrade.

Discharges and Separations

For the Montgomery GI Bill program, the discharge must be honorable. Discharges designated "under honorable conditions" and "general" do not establish eligibility. An honorable discharge for one of the following reasons may result in a reduction of the required length of active duty:

- convenience of the government

- disability

- hardship

- a medical condition existing before service

- force reductions

- physical or mental conditions that prevent satisfactory performance of duty

Education and Training Available

The following are available under the Montgomery GI Bill:

- Courses at colleges and universities leading to associate, bachelor or graduate degrees, and accredited independent study

- Courses leading to a certificate or diploma from business, technical or vocational schools

- Apprenticeship or on-job training programs for individuals not on active duty

- Correspondence courses, under certain conditions

- Flight training, if the veteran has a private pilot license and meets the medical requirements upon beginning the training program

- Tutorial assistance benefits if the individual is enrolled in school halftime or more, and refresher, deficiency and similar training

- State-approved teacher certification programs.

Other Items Covered Under this Education Bill

- Work study;

- Counseling services

Montgomery GI Bill (Selected Reserve) Eligibility

The Montgomery GI Bill (Selected Reserve) provides education benefits to members of the reserve elements of the Army, Navy, Air Force, Marine Corps and Coast Guard, and to members of the Army National Guard and the Air National Guard. To be eligible for the program, a reservist must:

- Have a six-year obligation to serve in the Selected Reserve signed after June 30, 1985, or, if an officer, agree to serve six years in addition to the original obligation

- Complete Initial Active Duty for Training (IADT)

- Have a high-school diploma or equivalency certificate before completing IADT

- Remain in good standing in a Selected Reserve unit.

Education and Training Available

Reservists may seek an undergraduate degree, go for graduate training, or take technical courses at colleges and universities. Flight training also is allowed. Those who have a six-year commitment beginning after Sept. 30, 1990, may take courses for a certificate or diploma from business, technical or vocational schools; cooperative training; apprenticeship or on-the-job training; correspondence courses; independent study programs; flight training; tutorial assistance; remedial, refresher and other training; and state-approved certification programs for training alternate teachers.

Period of Eligibility

If a reservist stays in the Selected Reserve, benefits end 10 years from the date the reservist became eligible for the program. VA may extend the 10-year period if the individual could not train due to a disability caused by Selected Reserve service. If a reservist leaves the Selected Reserve because of a disability, the individual may use the full 10 years. VA may also extend the 10-year period if the reservist was ordered to active duty. In other cases, benefits end the day the reservist leaves the Selected Reserve, except that certain individuals separated from the Selected Reserve due to downsizing of the military between Oct. 1, 1991, and Sept. 30, 1999, will have the full 10 years to use their benefits. If the 10-year period ends while the participant is attending school, however, VA may pay benefits until the end of the term. If the training is not on a term basis, payments may continue for 12 weeks.

Other Items Covered Under this Education Bill

- Work study

- Counseling services

*VOCATIONAL REHABILITATION

A disabled veteran may receive employment assistance, self-employment assistance, training in a rehabilitation facility, and college and other training. Severely disabled veterans may receive assistance to improve their ability to live independently or to benefit from vocational rehabilitation.

Eligibility

Veterans and service members are eligible for vocational rehabilitation if they meet these three conditions:

- They suffer a service-connected disability or disabilities in active service that is rated at least 20 percent disabling. Veterans with a 10 percent disability may also be found eligible if they have serious employment handicap.

- They are discharged or released under other than dishonorable conditions or are hospitalized and awaiting separation for a service-connected condition at least 20 percent disabling.

- They need rehabilitation to overcome an employment handicap caused substantially from a service-connected disability.

Period of Rehabilitation Program

The veteran must complete a rehabilitation program within 12 years of a military discharge. This period may be extended if a medical condition prevented the veteran from training or if the veteran has a serious employment handicap. Disabled veterans may receive services until they have reached their rehabilitation goal, up to 48 months. VA may provide counseling, job placement and post-employment services for up to 18 additional months.

Rehabilitation Program Costs

VA will pay the costs of tuition and required fees, books, supplies and equipment. VA may also pay for special support, such as tutorial assistance, prosthetic devices, lip-reading training and signing for the deaf. VA will help the veteran to pay for at least part of the transportation expenses unique to disabled people during training or the employment stages of the program. VA also can provide an advance against future benefit payments for veterans who run into financial difficulties during training.

Work Study

VA will pay participants in advance for work-study at the three-quarter or full-time rate. A participant with VA supervision can provide outreach services, prepare and process VA paperwork, work at a VA Medical Facility or perform other approved activities.

Program for Unemployable Veterans

Veterans awarded 100 percent disability compensation based upon unemployability may still request an evaluation. If found eligible, may participate in a vocational rehabilitation program and receive help in getting a job. A veteran who secures employment under the special program will continue to receive 100 percent disability compensation until the veteran has worked continuously for at least 12 months.

*HOME LOAN GUARANTIES

VA loan guaranties - to be used for the purchase of homes, condominiums and manufactured for refinancing loans - are made to service members, veterans, reservists and surviving spouses who have not remarried. VA guarantees part of the total loan, permitting the purchaser to obtain a mortgage with a competitive interest rate, even without a down payment if the lender agrees. VA requires that a down payment be made for the purchase of a manufactured home. VA also requires a down payment for a home for condominium if the purchase price exceeds the reasonable value of the property or the loan has a graduated payment feature. With a VA guaranty, the lender is protected against loss up to the amount of the guaranty if the borrower fails to repay the loan. A VA loan guaranty can be used to:

- Buy a home.

- Buy a residential condominium.

- Build a home.

- Repair, alter or improve a home.

- Refinance an existing home loan.

- Buy a manufactured home with or without a lot.

- Buy and improve a manufactured home lot.

- Install a solar heating or cooling system or other weatherization improvements.

- Purchase and improve a home simultaneously with energy efficient improvements.

- Refinance an existing VA loan to reduce the interest rate and make energy-efficient improvements.

- Refinance a manufactured home loan to acquire a lot.

Eligibility

Applicants must have a good credit rating, have an income sufficient to support mortgage payments, and agree to live in the property. To obtain a VA certificate of eligibility, complete VA Form 26-1880, "Request for Determination of Eligibility and Available Loan Guaranty Entitlement,". Eligibility varies with service.

Guaranty Amount

The amount of the VA guaranty available to an eligible veteran is called the entitlement and may be considered the equivalent of a down payment by lenders. Up to $50,750 in entitlement may be available to veterans purchasing or constructing homes to be financed with a loan of more than $144,000 and to veterans who obtain an Interest Rate Reduction Refinancing Loan of more than $144,000. The amount of entitlement varies with the loan amount.

VA does not establish a maximum loan amount. No loan for the acquisition of a home, however, may exceed the reasonable value of the property. A loan for the purpose of refinancing existing mortgage loans or other liens secured on a dwelling is generally limited to 90 percent of the appraised value of the dwelling. A loan to reduce the interest rate on an existing VA-guaranteed loan, however, can be made for an amount equal to the outstanding balance on the old loan plus closing costs, reasonable discount points and energy-efficient improvements. A loan for the purchase of a manufactured home or lot is limited to 95 percent of the amount that would be subject to finance charges. The VA funding fee and up to $6,000 in energy-efficient improvements also may be included in the loan. A veteran who previously obtained a VA loan can use the remaining entitlement for a second purchase. The amount of remaining entitlement is the difference between $36,000 or $50,750 for special loans, and the amount of entitlement used on prior loans. Veterans refinancing an existing VA loan with a new VA loan at a lower interest rate need not have any entitlement available for use.

Required Occupancy

Veterans must certify that they intend to live in the home they are buying or building with a VA guaranty. A veteran who wishes to refinance or improve a home with a VA guaranty also must certify to being in occupancy at the time of application. A spouse may certify occupancy if the buyer is on active duty. In refinancing a VA guaranteed loan solely to reduce the interest rate, veterans need only certify to prior occupancy.

Closing Costs

Payment in cash is required on all home loan closing costs, including title search and recording, hazard insurance premiums, prepaid taxes and a 1 percent origination fee, which may be required by lenders in lieu of certain other costs. In the case of refinancing loans, all such costs may be included in the loan, as long as the total loan does not exceed 90 percent of the reasonable value of the property. Interest Rate Reduction Refinancing Loans may include closing costs and a maximum of 2 discount points. Loans, including refinancing loans, are charged a funding fee by VA, except for loans made to disabled veterans and unremarried surviving spouses of veterans who died as a result of service. The VA funding fee is based on the loan amount and, at the discretion of the veteran and the lender, may be included in the loan.

Financing, Interest Rates and Terms

Veterans obtain VA-guaranteed loans through the usual lending institutions, including banks, savings and loan associations, building and loan associations, and mortgage loan companies. Veterans may obtain a loan with a fixed interest rate, which may be negotiated with the lender. If the lender charges discount points on the loan, the veteran may negotiate with the seller as to who will pay points or if they will be split between buyer and seller. Points paid by the veteran may not be included in the loan, except that a maximum of 2 points may be included in Interest Rate Reduction Refinancing Loans. The loan may be for as long as 30 years and 32 days. VA does not require that a down payment be made, except in the following instances: 1) a manufactured home or lot loan; 2) a loan with graduated payment features; and 3) to prevent the amount of a loan from exceeding VA's determination of the property's reasonable value. If the sale price exceeds the reasonable value, the veteran must certify that the difference is being paid in cash without supplementary borrowing. A cash down payment of 5 percent of the purchase price is required for manufactured home or lot loans.

Repossessed Houses

VA sells homes that have been acquired after foreclosure of a VA-guaranteed loan. These homes are available to both veterans and nonveterans. Contact local real estate agents for available listings.

Safeguards for Veterans

- Homes completed less than a year before purchase with VA financing and inspected during construction by either VA or HUD must meet VA requirements.

- VA may suspend from the loan program those who take unfair advantage of veteran borrowers or decline to sell a new home or make a loan because of race, color, religion, sex, disability, family status or national origin.

- The builder of a new home is required to give the purchasing veteran a one-year warranty that the home has been constructed to VA-approved plans and specifications. A similar warranty must be given for new manufactured homes.

- In cases of new construction completed under VA or HUD inspection, VA may pay or otherwise compensate the veteran borrower for correction of structural defects seriously affecting livability if assistance is requested within four years of a home-loan guaranty.

- The borrower obtaining a loan may only be charged the fees and other charges prescribed by VA as allowable.

- The borrower can prepay without penalty the entire loan or any part not less than the amount of one installment or $100.

- VA encourages holders to extend forbearance if a borrower becomes temporarily unable to meet the terms of the loan.

*BURIAL BENEFITS

VA Cemeteries

Burial benefits in a VA National Cemetery include the gravesite, a headstone or marker, opening and closing of the grave, and perpetual care. Many national cemeteries have columbary or gravesites for cremated remains.

Veterans and service members are eligible for burial in VA national cemetery. An eligible veteran must have been discharged separated from active duty under conditions other than dishonorable and have completed the required period of service. Those entitled to retired pay as a result of 20 years creditable service with a reserve component are eligible. A U.S. citizen who served in the armed forces of a government allied with the United States in a war also may be eligible. A 1997 law bars persons convicted of federal or state capital crimes from being buried or memorialized in one of the VA national cemeteries or in Arlington National Cemetery.

Spouses and minor children of eligible veterans and of service members also may be buried in a national cemetery. Adult children incapable of self-support due to physical or mental disability are eligible for burial. If a surviving spouse of an eligible veteran marries a nonveteran, and remarriage was terminated by divorce or death of the nonveteran, the spouse is eligible for burial in a national cemetery.

Gravesites in national cemeteries cannot be reserved. Funeral directors or others making burial arrangements must apply at the time of death. Reservations made under previous programs are honored. Cemeteries do not provide military honors but may make referrals to military units or volunteer groups. The National Cemetery Administration normally does not conduct burials on weekends. A weekend caller, however, will be directed to one of three VA cemetery offices that remain open during weekends to schedule burials at the cemetery of the caller's choice during the following week.

Arlington National Cemetery

Arlington National Cemetery is under the jurisdiction of the Army. Eligibility for burials is more limited than other national cemeteries.

*HEADSTONES AND MARKERS

VA provides headstones and markers for the unmarked graves of veterans anywhere in the world and of eligible dependents of veterans buried in a national, state veteran or military post cemeteries. Flat bronze, flat granite, flat marble, upright granite and upright marble types are available to mark the grave in a style consistent with the cemetery. Niche markers also are available for identifying cremated remains in columbary.

Headstones and markers are inscribed with the name of the deceased, branch of service, and the years of birth and death. Optional items that may be inscribed are military grade, rank or rate; war service such as "World War II"; months and days of birth and death; an emblem reflecting one's religion; and text indicating valor awards. When burial is in a national, state veteran or military post cemetery, the headstone or marker is ordered through the cemetery, which will place it on the grave. Information on style, inscription and shipping can be obtained through the cemetery.

When burial occurs in a cemetery other than a national, military post or state veterans cemetery, the VA must handle the application for the headstone or marker. It is shipped at government expense. VA, however, does not pay the cost of placing the headstone or marker.

Headstone or Markers for Memorial Plots

To memorialize an eligible veteran whose remains are not available for burial, VA will provide a memorial headstone or marker. The headstone or marker is the same as that used to identify a grave except that the phrase "In Memory of" precedes the inscription. The headstone or marker is available to memorialized eligible veterans or deceased service members whose remains were not recovered or identified, were buried at sea, donated to science, or cremated and scattered. The memorial marker also may be provided for placement in a cemetery other than a national cemetery. In such cases, VA supplies the marker and pays the cost of shipping, but does not pay for the plot or the placement of the marker.

Burial Flags

VA provides an American flag to drape the casket of a veteran or a reservist entitled to retired military pay. After the funeral service, the flag may be given to the next of kin or a close associate. Flags are issued at VA regional offices and national cemeteries, and post offices.

Reimbursement of Burial Expenses

VA will pay a burial allowance up to $1,500 if the veteran's death is service-connected. In some instances, VA also will pay the cost of transporting the remains of a service-disabled veteran to the national cemetery nearest the home of the deceased that has available gravesites. In such cases, the person who bore the veteran's burial expenses may claim reimbursement from VA.

VA will pay a $300 burial and funeral expense allowance for veterans who, at time of death, were entitled to receive pension or compensation or would have been entitled to compensation but for receipt of military retirement pay. Eligibility also may be established when death occurs in a VA facility, a nursing home under VA contract or a state nursing home. Additional costs of transportation of the remains may be paid. There is no time limit for filing reimbursement claims of service-connected deaths. In other deaths, claims must be filed within two years after permanent burial or cremation.

VA will pay a $150 plot allowance when a veteran is not buried in a cemetery that is under U.S. government jurisdiction under the following circumstances: The veteran was discharged from active duty because of disability incurred or aggravated in the line of duty; the veteran was in receipt of compensation or pension or would have been except for receiving military retired pay; or the veteran died in a VA facility. The $150 plot allowance may be paid to the state if a veteran is buried without charge for the cost of the plot or interment in a state-owned cemetery reserved solely by the deceased's employer or a state agency will not be reimbursed.

*DEPENDENTS EDUCATION

Educational assistance benefits are available to spouses who have not remarried and children of: (1) veterans who died or are permanently and totally disabled as the result of a disability arising from active military service; (2) veterans who died from any cause while rated permanently and totally disabled from service-connected disability; (3) service members listed for more than 90 days as currently missing in action or captured in line of duty by a hostile force; (4) servicemembers listed for more than 90 days as currently detained or interned by a foreign government or power.

Benefits may be awarded for pursuit of associate, bachelor's or graduate degrees at colleges and universities--including independent study, cooperative training and study-abroad programs. Courses leading to a certificate or diploma from business, technical or vocational schools also may be taken.

Benefits may be awarded for apprenticeships, on-job-training programs and farm cooperative courses. Benefits for correspondence courses under certain conditions are available to spouses only. Secondary-school programs may be pursued if the individual is not a high-school graduate. An individual with a deficiency in a subject may receive tutorial benefits halftime or more. Deficiency, refresher and other training also may be available.

Other Benefits Available Under this Program

- Work study

- Counseling services

- Special benefits

- Spina Bifida assistance

Educational Loans

Loans are available to spouses who qualify for educational assistance. Spouses who have passed their 10-year period of eligibility may be eligible for an educational loan. During the first two years after the end of their eligibility period, they may borrow up to $2,500 per academic year to continue a full-time course leading to a college degree or to a professional or vocational objective which requires at least six months to complete. VA may waive the six-month requirement. Loans are based on financial need.

Home Loan Guaranties

A VA loan guaranty to acquire a home may be available to an unremarried spouse of a veteran or service member who has been officially listed as missing in action or as a prisoner of war for more than 90 days. Spouses of those listed as prisoners of war or missing in action are limited to one loan.

Medals

Medals awarded while in active service are issued by the appropriate service if requested by veterans or, if deceased, their next of kin.

*STATE-SUPPORTED BENEFITS

Remission of fees for the children of a disabled veteran

The natural or legally adopted children of a disabled veteran may be eligible for remission of fees at any state-supported post secondary school or university in the State of Indiana. This applies regardless of the age of the child as long as the child is a resident of the state. The rules are:

- The veteran must have served in active duty U.S. Armed Forces during a period of wartime.

- The veteran must be declared to be disabled by the U.S. Department of Veterans Affairs, or the Department of Defense (if the Department of Defense, the veteran must supply official documentation) even if the disability is 0% and non-compensatory.

- The veteran received a Purple Heart Medal. (Official documentation of the award is required).

- The veteran was a resident of Indiana at the time of entry into the service and was declared a POW or MIA after Jan 1, 1960.

- The student was a veteran related pupil at the Indiana Soldiers and Sailors Children's Home.

The remission of fees is good for 124 semester hours of education and may be used for either undergraduate or graduate level work. Ref: IC 20-12-19-1 and IC 10-5-16.5-3.

Property Tax Abatements

Property tax deductions are available to disabled Hoosier Veterans under the following conditions:

1. A $12,480.00 abatement is available to veterans who:

a. Served at least 90 days of honorable service

b. Are totally, (not necessarily service-connected but the disability must be evidenced by a U.S. Department of Veterans Affairs pension certificate) OR

c. Are at least 62 years old and 10%

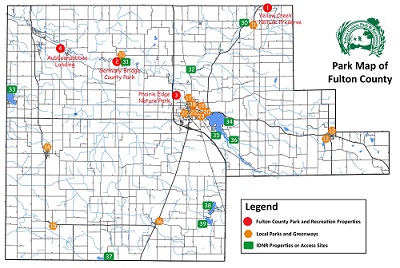

Germany Bridge County Park

Germany Bridge County Park is Fulton County’s first county park. Located at 4213 N 375 W, along the Tippecanoe River, it has picnic areas, fishing, a restroom, 900 plus feet of riverfront and an Indiana DNR public access site. The Germany Bridge Meeting Center is available to rent for your family gathering, organization's meeting place or other activities.

Germany Bridge Meeting Center Rental Agreement

Prairie Edge Nature Park

Prairie Edge Nature Park is located at the intersection of West 3rd Street and U.S. Highway 31. It has a five acre fishing pond, a pavilion, a gazebo, a butterfly garden, picnic areas, restrooms, and walking trails through areas planted with native wild flowers, trees, and prairie grasses.

Yellow Creek Nature Preserve

Yellow Creek Nature Preserve is located at 7120 E 775 N. It is closed to the public and maintained as a wildlife and nature preserve.

Aubbeenaubbee Landing

Aubbeenaubbee Landing is located at 7806 West Olson Road, along the Tippecanoe River. The park department has partnered with the Indiana Department of Natural Resources to provide a public access site with a parking area, fishing site and canoe launch. Future plans include a pavillion, picnic area, and additional parking.

Click on the map below.

Court Appointed Special Advocates or CASA of Fulton County are individuals from all walks of life that have received training to advocate for children of Fulton County. CASA’s are a child’s voice in court.

For more information, please visit our website.

Each year after the May 10th tax payment deadline, personal properties and mobile homes that are delinquent from the prior year will be subject to an $8.00 demand fee, If not paid within 60 days from the date of the demand, the demand will become a certified judgment to the Fulton County Clerk of the Courts. After the demand fee is attached to the property, the payment must be made to Eagle Accounts 7510 Madison Avenue, Indianapolis, IN 46227. 888-322-EAGL

- No fee is required to file a claim against an estate.

- Confirm that an estate has been opened in Fulton County.

- The Court Case Number and full name of the Decedent must be included on the claim.

Submit the following in triplicate to:

Fulton County Clerk, ATTN: Probate

815 Main St.,

Rochester, IN 46975

- Written claim statement, Notarized signature of Claimant.

- Billing Statement

- Stamped envelope addressed to Claiman

Forms are not provided by the Clerk

Statutory Authority

Ind. Code 29 -1-7- 3.1 allows a person to deposit a will and/or codicil (hereinafter “will”) with the Circuit Court Clerk. The will may be deposited with the Circuit Court Clerk of the county in which the testator resided when the will was executed. The Circuit Court Clerk does not have to determine whether his or her county is the right place for the filing. The statute allows the Circuit Court Clerk to assume, without inquiring further, the depositor of the will is correct about the testator's county of residence.

The Mechanics

- The Circuit Court Clerk shall collect a $25.00 fee for the deposit of the will. The Circuit Court shall waive the fee if a court with probate jurisdiction in the county where the will is deposited certifies that the depositor is a participant of, or acting on behalf of, a participant of a Supreme Court Program, such as the Judges and Lawyers Assistance Program, and the certification accompanies the will. The Circuit Court may waive the fee if the depositor no longer practices law.

- The Circuit Court Clerk shall then deposit the fee into the Circuit Court Clerk's Record Perpetuation Fund (Ind. Code 33-37-5-2).

- Upon receipt of the will, the Circuit Court Clerk shall provide the depositor with a receipt for the will, place the will in an envelope, and seal the envelope in the presence of the depositor.

- The Clerk shall then designate on the envelope: the date of the deposit, the name of the testator and the name and address of the depositor.

- The Clerk will index the will alphabetically by the name of the testator.

- A will filed pursuant to this statute does NOT receive a case number, unless the number is assigned under the “CB-Court Business Record” designation.

courts.IN.gov 1

Access to Will

- Public Access: Public access to the will is not allowed because the deposited will is not a public record in under Ind. Code 5-14-3.

- Testator’s or authorized person’s access: During the testator’s lifetime, the Clerk must keep the envelope containing the will sealed and deliver the envelope ONLY to the testator or a person authorized in writing, signed by the testator, to receive the envelope. After the death of the testator, the Clerk may deliver the will to the court that has jurisdiction of the administration of the decedent's estate.

Retention of Will

Under Ind. Code 29-1-7-3.1, the Circuit Court Clerk may destroy the deposited will if

- The Clerk has not received notice of the Testator’s death and

- At least one hundred (100) years has passed since the will was deposited.

CONTACT: Richard T. Payne

Direct: 317-234-5398

30 S. Meridian St., Suite 500

Indianapolis, IN 46204

Main: 317-232-2542

Fax: 317-233-6586

All of the information provided on this website is a matter of public record. The information on the website may not be current and may not reflect actual status as of the retrieval date. The information on this website is not intended for any official or legal use.

The information contained herein is part of the public record as it existed on the date of retrieval. The information will be updated periodically.

Fulton County assumes no responsibility for the validity of any information presented herein, nor any responsibility for the use or misuse of this data.

If you understand this disclaimer and agree to its terms, please click the link below.

Fulton County Government GIS Site

WTHGIS allows taxpayers to view property record cards, aerial photographs, tax amounts, deductions and much more!

- Private Water Well Information

- List of Well Drillers

- Directions for Disinfecting Wells

- EPA National Primary Drinking Water Standards

- Indiana Department of Natural Resources FAQ

- Maximum Contaminate Levels for Drinking Water

- Recommended Standards for Private Water Wells

- Testing Your Private Well Water

- Ways to Conserve Water

Commissary is held once a week. Inmates are able to order commissary and indigent items throughout the week, but all orders need to be in by 11:00 p.m. Sunday.

Commissary orders are delivered on Tuesday or at the descretion of the jail staff. Inmates must have money placed in their trust fund accounts to be able to purchase items.

Family and friends can deposit funds to inmates accounts by way of the money orders, the depository in the jail lobby or by computer by going to JailATM and following the steps given.

Commissary is completed strictly at the on-duty Jailer's convenience. Commissary is a privilege, not a right, and it can be taken away for any just cause. See "trust fund", for information on how and when inmates can receive money.

Inmate's outgoing mail will be picked up at the discretion of the on-duty Jail Officer. Inmates are required to put their full name above the address when sending mail. If the inmate does not put their full name in the upper left hand corner of the envelope, the mail will not be accepted for delivery through the United States Post Office. Incoming mail will be delivered to the inmate Monday through Saturday, except Holidays. Any incoming mail received that does not have a name and address of the sender will be confiscated and placed in the inmate's property to be received upon release.

Incoming mail will be inspected prior to the inmate receiving it, with the exception of legal mail, unless contraband is suspected. No mail or notes from other inmates confined in this or any other jail or prison facilities will be allowed in the Fulton County Jail.

Mail containing stickers and/or colored drawings/paintings/glitter will result in being confiscated and held until the release of the inmate.

No packages will be allowed to be mailed to any inmate without prior written consent from the Jail Commander, or the package will be sent back to the sender. All packages need to be under $1.50 in postage. Contents and sender must be disclosed.

Books and/or magazines need to be sent directly from the respective publisher if consent is given by the Jail Commander for the inmate to receive.

No items will be accepted through the lobby without the Jail Commander's prior written approval.

Fulton County levies a tax on every person engaged in the business of renting or furnishing, for periods of less than 30 days, any room or rooms, lodgings, or accommodations in any hotel, motel, boat motel, inn or tourist cabin located in Fulton County. The tax is levied at 3% on the gross retail income derived from lodging income only, and in addition to any other taxes imposed. The tax shall be paid monthly to the Fulton County Treasurer, not later than the 20th day of the following month. Payments along with the forms can be mailed to the Fulton County Treasurer, 125 East 9th St, Rochester, IN 46975.

Search our records from your computer 24/7

We have several ways our records are available to you.

Tapestry allows you to search our records for a fee of $6.95 per search plus $1.00 per page for anything you print.

If you prefer to have permanent ability to search records by subscription, you may open a Laredo account with us. Following minutes and rates are available:

|

250 minutes per month |

$50.00 |

|

1000 minutes per month |

$100.00 |

|

3000 minutes per month |

$200.00 |

|

Unlimited minutes per month |

$250.00 |

An account may be opened by calling me at 574-223-2914. This account allows you to search our records from your desk at your convenience. You may also print anything you wish and your account will be charged $1.00 per page pursuant to statutes. Bills are sent out monthly.

Our current database, images and indexing are complete from January 1, 1988 to the current date. We are currently working on getting all images indexed on the computer system. We have deeds so far back to 1969.

Updates on our progression will be available to you as a Laredo customer whenever you sign on to your account.

This is a valuable tool for your office which expedites getting the information you need.

Indiana Code (specifically IC 6-1.1-4-13.6) requires the County Assessor to determine land values and Submit them to the Property Tax Assessment Board of Appeals no later than July 1. The land values will be applied going forward (example: Land Values applied in 2012 to be payable in the 2013 assessment year).

Please go to the State of Indiana website to begin the process of applying for your marriage license. Once that is done you and your intended will come to the Fulton County Clerk's office to finish the process.

All parents in dissolution of marriage cases with minor children are required to attend a class at Four County Counseling Center designed to minimize the impact of dissolution on the child(ren).

THE FULTON COUNTY JAIL HAS MADE A CHANGE IN WEEKEND VISITATION EFFECTIVE IMMEDIATELY. PLEASE BE INFORMED THAT THE TIME FOR VISITATION ON WEEKENDS ARE NOW:

1:00 - 3:30 PM. FOR BOTH DAYS.

Visitation hours for inmates are held on Wednesday from 1:00 p.m. to 3:30 p.m. as well as 5:30 p.m. to 9:00 p.m. Visits will be limited in the duration of fifteen (15) minutes per inmate, and even though there are two separate visitation times on Wednesday, inmates can only have one visit for the day.

Weekend visitation schedule will be as follows: Inmates with last names ranging from A to L will have visitation on Saturday from 1:00 p.m. to 3:30 p.m. Those inmates with last names ranging from M to Z will have visitation on Sunday from 1:00 p.m.to 3:30 p.m., unless other arrangements have been previous approved.

Any inmate wanting visitors must supply the jail a list of no more than three (3) people that they want to visit, and the list can only be changed at the first of every month. Visitors must have a valid form of ID to confirm identification at the time of visitation. A parent or guardian must escort any persons under the age of eighteen (18) and that parent or guardian must be on the inmate's visitation list. An inmate's immediate children under the age of eighteen (18) will not be counted as one of the allotted three (3) visitors.

Disruptive and/or disorderly behaviors will not be allowed by the inmate or the visitor and is a just cause to terminate the visit. The amount of visitors an inmate may have at one time is left to the discretion of the on duty Jail Officer.

Proper dress will be required during visitation. It will be the discretion of the on duty Jail Officer if dress is not appropriate. The visitor will be asked to correct the dress concern and if not corrected, the visitor will be asked to leave and the visit will be terminated.

Use of cameras or cell phones is not allowed in the visitation booth. If visitor is seen or observed using such items, the visitation will be terminated immediately.

Mobile Home Permits

If you have questions after reading the information below on mobile home assesments/title transfers/demands /judgments, please feel free to contact the County Treasurer's Office at 574-223-2913 or by email at fctreasurer@rtcol.com.

Mobile Home Assessment by County Assessor

In the State of Indiana mobile homes located in mobile home parks or on land not owned by the mobile home owner are assessed as of January 15th each year. Mobile home owners receive a notice of assessment from the County Assessor on or about January 15th each year. Mobile home taxes are paid in the current year so a January 15th assessment means you will receive a tax bill that will be due May 10 and November 10 of the current year.

Mobile Home Title Transfer

There is a $10 fee for Mobile Home Permits.

Permits are required for all transfers and moving of mobile homes.

If the mobile home is no longer owned by the person listed on the assessment notice, the owner must know the location and size of the mobile home, bring the mobile home title to the County Treasurer's Office and apply for a Mobile Home Title Transfer Permit. All property tax must be paid to obtain the permit including property taxes assessed to previous owners. It is vital that mobile home transfers be obtained to prevent the titled owner from being saddled with future taxes after ownership has transferred. Advising the County Assessor of the transfer will not transfer the assessment records to the new owner. The only way to accomplish this is to apply for a Title Transfer Permit through the County Treasurer's Office.

Mobile Home Title Transfer

Upon receipt of the Mobile Home Title Transfer from the County Treasurer's Office it must be taken along with the title to the Bureau of Motor Vehicles for the transfer of the title.

Lost Title

If the title is lost for the mobile home, you will need to contact the law enforcement division serving your residence to request a VIN check. The officer will complete a form indicating the VIN number on the mobile home so the Bureau of Motor Vehicles can track the mobile home ownership in their records. You will need a Mobile Home Permit showing the taxes have been paid on the mobile home. With the location of the mobile home, the Treasurer's Office will be able to identify the last owner assessed for the mobile home. All property tax must be paid to obtain the permit including property taxes assessed to previous owners. You would need to apply for a duplicate or replacement title at the Bureau of Motor Vehicles.

Failure to Pay Mobile Home Tax Demand Notices/Judgments/Payments to Eagle Accounts

Mobile home tax not paid within one year of being billed will receive a DEMAND NOTICE. Failure to pay the demand will result in the taxes being certified to the Clerk of the Courts as a judgment. The tax amount certified continues to have additional penalties added on a daily basis. Payment for judgments may be made by phone through Eagle Accounts 1-888-322-3245.

Mobile Home Exemptions

Mobile home owners may apply for a homestead credit if the mobile home is a full time, permanent residence as evidenced by where the taxpayer files his Indiana income tax, where the taxpayer votes and where the taxpayer registers their vehicles. Mobile home owners may apply for a mortage exemption also if the mortgage is recorded in the County Recorder's Office. The maximum deduction for a mobile home is one half of the assessed value. Exemptions are filed in the County Auditor's Office. You may contact the County Auditor's Office at 574-223-2912.

News & Notices

Useful Links

Contact Us

(More about Fulton County Courthouse)

815 N Main St

Rochester, IN 46975

Get Directions

Contact Us

- Phone: (574) 223-2385

- Fax: (574) 223-9852

- Staff Directory

Contact Us

- Phone: (574) 223-7667

- Fax: (574) 223-3652

- Staff Directory

- Office Hours:

Monday - Friday: 8am - 4pm

Contact Us

Assessor

(More about Assessor's Office)

125 E 9th St

Suite 026

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2801

- Fax: (574) 224-2801

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2912

- Fax: (574) 223-2211

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-6164

- Fax: (574) 223-8304

- Staff Directory

Contact Us

- Phone: (574) 223-2911

- Fax: (574) 223-8304

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m

Contact Us

1200 W 18th St

Rochester, IN 46975

Get Directions

Mailing Address

Rochester

, PO Box 453

IN, 46975

- Phone: (574) 223-1200

- Fax: (574) 223-1400

- Mobile: (574) 540-3177

- Staff Directory

Contact Us

Contact Us

Contact Us

Judge

- Phone: (574) 223-4339

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Closed 12:00 - 1:00 p.m. for lunch

Contact Us

Contact Us

(More about Emergency Management Agency)

1728 E State Road 14 E

Rochester, IN 46975

Get Directions

- Phone: (574) 223-6611

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2385

- Fax: (574) 223-9852

- Staff Directory

- Office Hours:

Memorial Day - Labor Day:

M - Th. 6:00 a.m. - 4:30 p.m.

Labor Day - Memorial Day:

M - F 7:00 a.m. - 3:30 p.m.

Contact Us

Contact Us

- Phone: (574) 223-4345

- Fax: (574) 223-9112

- Staff Directory

- Office Hours:

M 8:00 a.m. - 7:00 p.m.

Tu. - F 8:00 a.m. - 4:30 p.m.

Contact Us

Contact Us

- Phone: (574) 223-2881

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

(More about Recorder's Office)

125 E 9th St

Suite 120

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2914

- Fax: (574) 223-4734

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2819

- Other: (800) 419-2819

- Fax: (574) 223-8990

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-4939

- Fax: (574) 224-4939

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Sat. 8:00 a.m. - 12:00 p.m.

Contact Us

(More about Fulton County Office Building)

125 E 9th St

Rochester, IN 46975

Get Directions

- Phone: (574) 223-3317

- Staff Directory

- Office Hours:

Monday-Friday from 8:00am to 4:00pm *Please note during these scheduled work hours we may be out of the office due to being in the field; Please call ahead (574) 223-3317, you may feel free to leave us a voice message and we will return your call as soon as we return.

Contact Us

(More about Treasurer's Office)

125 E 9th St

Suite 112

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2913

- Fax: (574) 223-7742

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2217

- Fax: (574) 223-2261

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 2:00 p.m.

Contact Us

Contact Us

Contact Us

Contact Us

(More about Emergency Management Agency)

1728 E State Road 14 E

Rochester, IN 46975

Get Directions

- Phone: (574) 223-6611

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

Contact Us

Contact Us

Contact Us

- Phone: (574) 223-4345

- Fax: (574) 223-9112

- Staff Directory

- Office Hours:

M 8:00 a.m. - 7:00 p.m.

Tu. - F 8:00 a.m. - 4:30 p.m.

Contact Us

- Phone: (574) 223-4345

- Fax: (574) 223-9112

- Staff Directory

- Office Hours:

M 8:00 a.m. - 7:00 p.m.

Tu. - F 8:00 a.m. - 4:30 p.m.

Contact Us

- Phone: (574) 223-7730

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-7466

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-7730

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2883

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-5152

- Fax: (574) 223-2335

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

(More about Recorder's Office)

125 E 9th St

Suite 120

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2914

- Fax: (574) 223-4734

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

(More about Recorder's Office)

125 E 9th St

Suite 120

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2914

- Fax: (574) 223-4734

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2819

- Fax: (574) 223-8990

- Other: (800) 419-2819

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m. Lobby Open 24/7

Contact Us

- Phone: (574) 223-2819

- Fax: (574) 223-8990

- Other: (800) 419-2819

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m. Lobby Open 24/7

Contact Us

- Phone: (574) 224-5630

- Fax: (574) 224-8990

- Other: (800) 419-2819

- Staff Directory

Contact Us

- Phone: (574) 223-2819

- Fax: (574) 223-8990

- Other: (800) 419-2819

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m. Lobby Open 24/7

Contact Us

- Phone: (574) 223-2819

- Fax: (574) 223-8990

- Other: (800) 419-2819

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m. Lobby Open 24/7

Contact Us

- Phone: (574) 223-2819

- Fax: (574) 223-8990

- Other: (574) 419-2819

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m. Lobby Open 24/7

Contact Us

(More about Treasurer's Office)

125 E 9th St

Suite 112

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2217

- Fax: (574) 223-2261

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

(More about Assessor's Office)

125 E 9th St

Suite 026

Rochester, IN 46975

Get Directions

- Phone: (574) 223-2801

- Fax: (574) 224-2801

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

- Phone: (574) 223-2911

- Fax: (574) 223-8304

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Contact Us

(More about Fulton County Office Building)

125 E 9th St

Rochester, IN 46975

Get Directions

- Phone: (574) 223-3492

- Staff Directory

- Office Hours:

Building hour are Monday-Friday from 8:00am -4:00pm. *The Drainage Board Secretary is located in the Surveyor's Office of the Annex Building in the lower level.

Contact Us

Contact Us

Contact Us

- Phone: (574) 223-3506

- Staff Directory

- Office Hours:

M - F 8:00 a.m. - 4:00 p.m.

Closed 12:00 - 1:00 p.m. for lunch

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

Contact Us

In this Department

- Department Home

- About the FCPC

- County Board of Finance

- Personnel

- Administration

- About Our Office

- Drainage Board

- Local Court Rules

- Environmental Health

- Local Court Rules

- Alcohol & Drug Court Program

- Friends of the Park

- ADA

- Advisory Board

- Court Forms

- Online Permitting and Board Applications

- Ordinances Enforced by the F.C.P.C.

- Legal Resources

- Communication Board Members

- Road Patrol

- Fulton County Dispatchers

- Recorder Requirements

- Park Board Members

- Community Corrections

- Food Protection

- Investigations

- Area Plan Commission Meetings, Agendas, & Packets

- Vector Control & Tobacco Regulations

- Fulton County BZA Meetings, Agendas, & Packets

- Court Forms

- Jail Division

- K - 9 Unit

- Vital Records

- Public Nursing

- Rochester BZA Meetings, Agendas, & Packets

- Akron BZA Meetings, Agendas, & Packets

- Narcotics Investigations

- Court Security

- Fulton/Kewanna BZA Meetings, Agendas, & Packets

- F.C. Comp Plan Update